Fiscal Stimulus Packages in Dealing with COVID-19 Consequences in Bangladesh: An Analysis of Institutional Capacity, Accountability, and Transparency

‘Bangladesh neither has nor is pursuing an export-led growth paradigm’

Using Direct Taxation to Boost Revenue and Tackle Inequality in Bangladesh

About the project

In the face of rising inequality, the role of a progressive direct taxation system (along with a redistributive public spending mechanism) is enormously important for ensuring a fair society. Although Bangladesh’s headline policy documents (e.g. Eighth Five Year Plan) proposes numerous tax reforms, there is a serious need for strengthening direct taxation to tackle inequality.Dependence on indirect taxes (e.g. VAT and customs duties) can exacerbate the existing income distribution. Currently, almost two-thirds of NBR revenue come from indirect taxes, which can disproportionately affect households on lower incomes. Furthermore, the political economy landscape tends to undermine the efforts to collect direct taxes. Against this backdrop, this project intends to contribute to the policy discourse through high-quality research and stakeholder sensitization to promote direct taxation as an effective policy instrument to boost revenue and reduce inequality in Bangladesh. This project is being undertaken with the support from Kivu International and International Growth Centre (IGC).

Project duration: January 2022-January 2023.

Project activities

Brainstorming session

Will Paxton and Jess Latchford from Kivu International paid a visit to RAPID - Dhaka on 22 February 2022. Kivu and RAPID team members discussed Bangladesh's impressive economic progress and the potential for improving direct taxation.

Jess Latchford from Kivu International visited RAPID - Dhaka on 22 May 2022. Kivu and RAPID team members discussed the potential policy reform measures that can help improve direct taxation.

Jack Lovell from Kivu International visited RAPID - Dhaka on 8 September 2022. Kivu and RAPID team members discussed the recent developments in tax policy reform to improve direct taxation.

Jack Lovell from Kivu International visited RAPID - Dhaka on 8 September 2022. Kivu and RAPID team members discussed the recent developments in tax policy reform to improve direct taxation.

Project progress sharing meeting

RAPID team members discussed updates on project progress and advocacy activities, political economy of taxation, and potential entry points for reform.

Pre-budget webinar

Research and Policy Integration for Development (RAPID) organized a webinar titled “Using Direct Taxation to Boost Revenue and Tackle Inequality” on 30th March 2022. Honourable Ambassador of Bangladesh to Germany and former chairman of National Board of Revenue Md Mosharraf Hossain Bhuiyan, ndc joined the webinar as the chief guest while another former Chairman of NBR Dr Nasiruddin Ahmed was present as the Guest of Honour. Former Governor of Bangladesh Bank Dr Md Atiur Rahman chaired the event. RAPID’s executive director Dr M Abu Eusuf moderated the event and delivered the welcome remarks.RAPID Chairman Dr M A Razzaque, made the keynote presentation at the webinar. Drawing from cross country evidence, Dr Razzaque highlighted the implication of current direct taxation regime on fiscal space and the growing inequality incidence. He noted that although the structure of taxation in Bangladesh has improved significantly over the past several years, the country is still highly dependent on indirect tax. Despite, robust economic growth, the direct tax (personal and corporate income tax) revenue-GDP ratio has declined considerably from a peak of 3.22% in 2012-13 to 2.67% in FY2020. Dr Razzaque underscored that the objective of any tax reform should not be only about raising revenue but also dealing with growing inequality as much as possible.

The presentation was followed by a panel discussion. Panelists from the NBR, Ministry of Finance, Bangladesh Bank and private sector delivered their remarks on the event.

Budget 2022-2023: Recommendations and Post-budget reflections

RAPID has put forward recommendation for budget 2022-2023. These recommendations focus on reforming direct taxation to tackle rapidly rising inequality while at the same time strengthening domestic resource mobilization efforts.Major Reflections on Budget 2022-23: Direct tax and inequality perspective

- The budget speech of FY2022-23 mentions the importance of direct taxation to tackle inequality. However, some measures may worsen the existing inequality situation.

- Despite soaring inflation, the tax-free income limit for individuals has been kept unchanged at Taka 3,00,000 in FY23. Such a limit could aggravate the existing inequality situation as the real income of individuals has declined.

- The budget speech for FY2022-23 states that, as of April 2022, only 7.5 million have the tax identification number (TIN). However, about 39 per cent of TIN holders submitted their tax returns.

- In FY23, the corporate tax rate has been reduced to 20 per cent from 22.5 per cent for listed companies, 27.5 per cent from 30 per cent for non-listed companies and 22.5 per cent from 25 per cent for one-person companies. It is worth noting that the corporate tax rate was slashed for third time in a row to deal with pandemic-induced impacts.

- Several other tax cuts were given to infuse dynamism in the private sector. However, collecting taxes from the existing taxpayers has been a longstanding challenge.

Watch the post-budget event here.

RAPID Chairman and Executive Director attended a budget-reaction event on the budget day. Watch the event here.

RAPID welcomes the government's decision to boost revenue collection from direct taxes

On the 3rd of September, at a national workshop on internal resources mobilisation and tariff rationalisation in Bangladesh, a national study group underscored the need for collecting more revenue from direct taxes. The tax policy study group recommends reversing the current ratio between direct and indirect taxation from 35:65 to 70:30 in favour of direct taxation. RAPID welcomes this decision. Read more on this blog post here.Capacity Building Workshop of Journalists

On 29 May 2022, Research and Policy Integration for Development (RAPID) hosted a capacity-building workshop with seven journalists from the country's main publications. The session, titled "Using Direct Taxation to Tackle Inequality and Boost Revenue” was moderated by RAPID Chairman Dr. Mohammad Abdur Razzaque.The Workshop focused on the importance of implementing direct taxation in Bangladesh to face the economic inequality. Journalists learned about the positive impact of direct taxation and how it can be a game-changer for the Bangladesh economy. An interactive Q&A session was incorporated in the course.

Seminar: Using Direct Taxation to Tackle Inequality and Boost Revenue

On 19 November 2022 , Research and Policy Integration for Development (RAPID), in collaboration with Economic Reporters’ Forum(ERF), organised a Seminar.The Seminar was attended by Nasiruddin Ahmed, former NBR chairman, Kabirul Yazdani, additional Secretary of the Finance Ministry, Md Mahmudur Rahman, NBR Member (tax survey and inspection), experts from academia, think-tanks as well as journalists of print media & electronic media. Dr. M A Razzaque, Chairman of RAPID, delivered the keynote presentation highlighting the study findings. RAPID Executive Director Dr Abu Eusuf moderated the event.

Media coverage

The Daily Stare The Financial Express The Business Standard Prothom alo Ekhon TV Independent TV

Policy Dialogue: Using Direct Taxation to Tackle Inequality and Boost Revenue

On 28 December 2022 , Research and Policy Integration for Development (RAPID), organised a Policy Dialogue at BRAC center Inn, Dhaka. The Policy Dialogue was attended by Dr. Muhammad Abdul Mazid, former Chairman, National Board of Revenue (NBR), Mr. M M Fazlul Haque, Director General of BCS (Tax) Academy, experts from academia, think-tanks as well as journalists of print media. RAPID Chairman Dr. M A Razzaque delivered the keynote presentation.

Media coverage

UNB The Business post The New Age

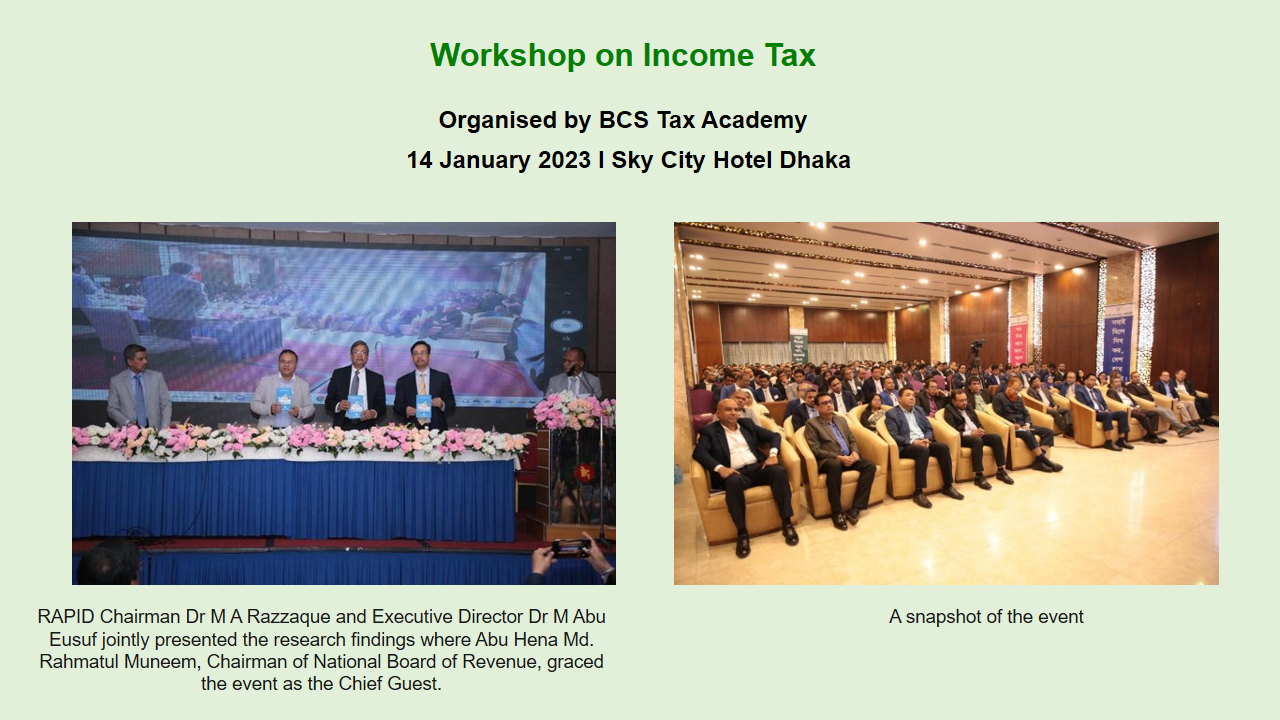

Workshop on Income Tax

On 14 January 2023, Bangladesh Civil Service (BCS) Tax Academy, the apex body entrusted to train government tax officials, organised a workshop at Sky City Hotel Dhaka. RAPID was invited to present research findings on direct tax at a workshop on Income Tax. Chairman of National Board of Revenue (NBR), Mr. Abu Hena Md. Rahmatul Muneem was present as the Chief Guest.More than 250 participants attended the event which included Members of NBR, about 30 tax commissioners, deputy commissioner of taxes from nine batches of Bangladesh Civil Service, amongst others.

RAPID Chairman Dr M A Razzaque and Executive Director Dr M Abu Eusuf jointly presented the research findings at the opening session of the workshop.

Data blogs

Direct tax and inequality

Bangladesh has one of the lowest direct tax to GDP ratio amongst the global economies. Income inequality, as indicated by the Gini Coefficient, is also high for Bangladesh. As can be seen from the figure below, Bangladesh's (BGD) direct tax to GDP ratio is just above 2 per cent and Gini Coefficient is close to 50 (A higher number means higher inequality). A cross-country comparison suggests that countries with higher direct tax to GDP ratio has lower inequality. Countires such as Indonesia(IDN), Bhutan(BTN), Thailand(THA) have higher direct tax to GDP ratio and less inequality.

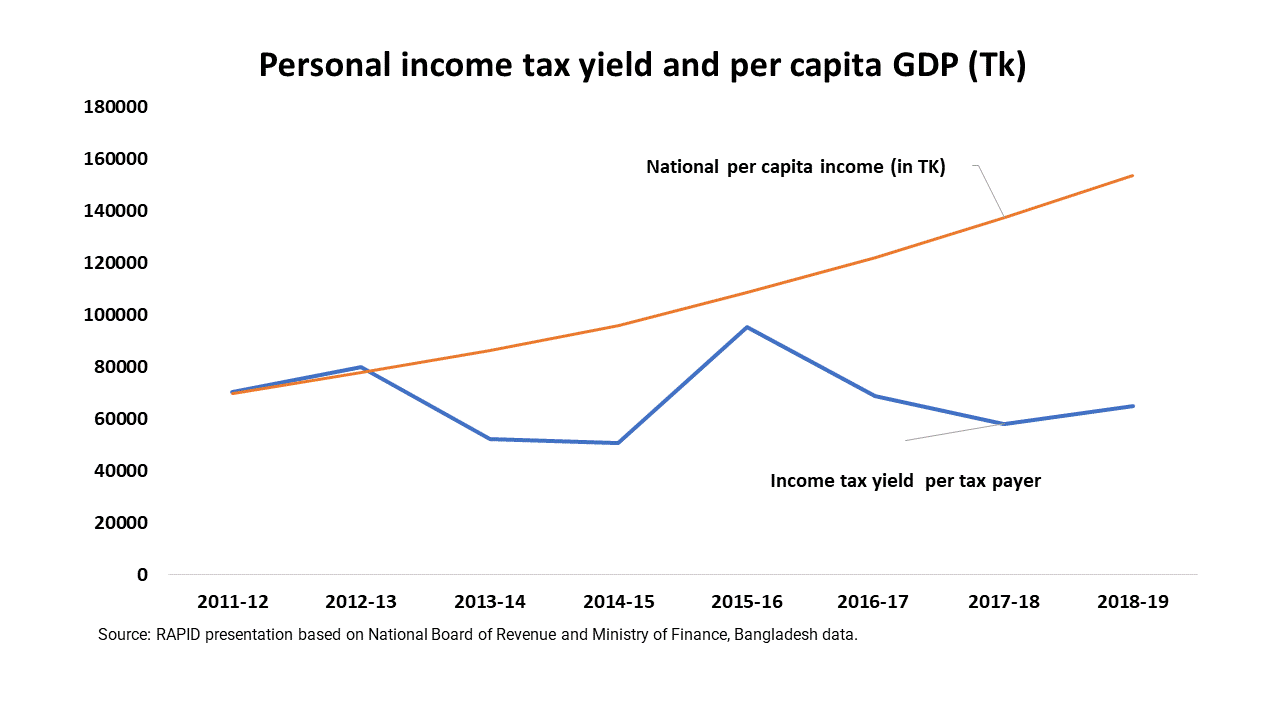

Rising per capita income versus declining income tax

Between 2012-13 and 2018-19, while per capita income almost doubled, tax revenue per taxpayer declined. This implies, despite impressive economic progress, Bangladesh failed to benefit from the existing progressive income taxation structure and the rapid growth of the economy.

Revenue generation in Bangladesh

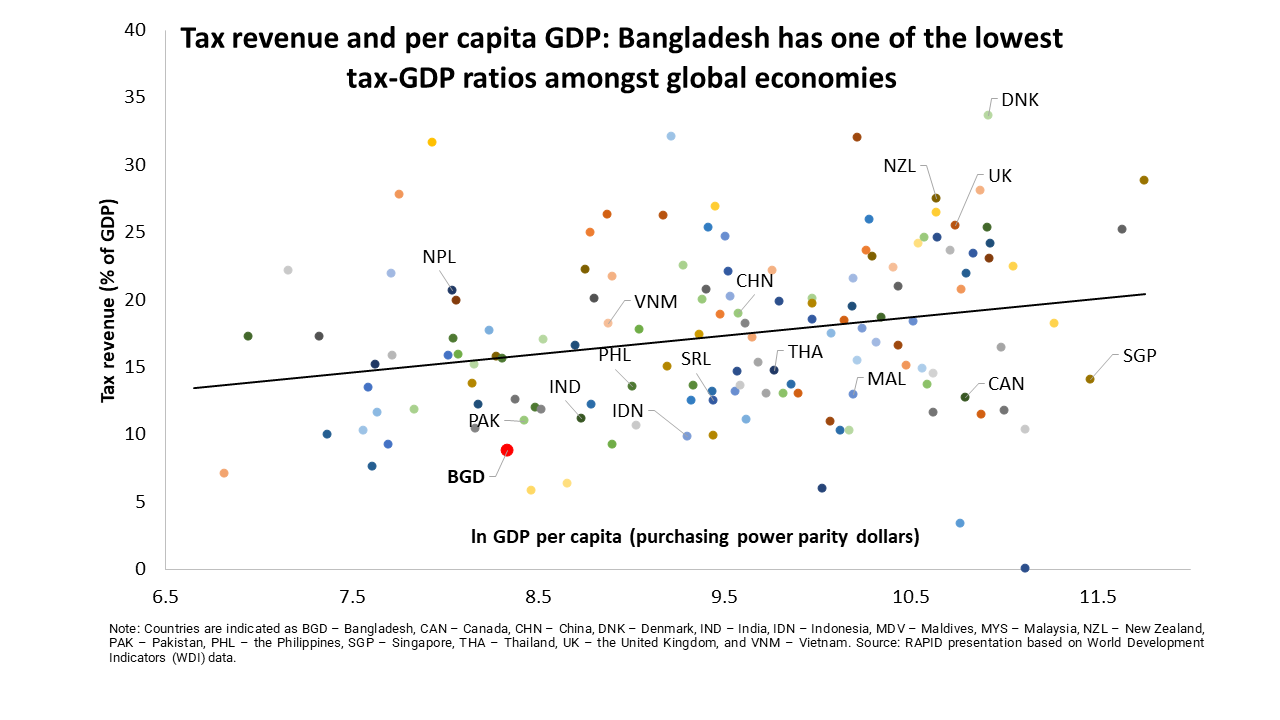

The domestic revenue generation in Bangladesh has been historically low. The average revenue-GDP ratio has been just around 10 per cent with the tax-GDP ratio remaining as one of the lowest amongst global economies—less than 9 per cent of GDP.As per the macroeconomic framework of the government’s Perspective Plan 2041, Bangladesh will have to raise its tax-GDP ratio from the current level to more than 17 per cent by 2031. Since the mid-1990s, the tax-GDP ratio has risen by just 1–2 percentage points. Therefore, the target of doubling the tax-GDP ratio over the next decade should constitute an important endeavour. Only additional tax resources can boost the overall size of budgetary expenditure, which can then help expand public spending on such sectors as health, education, transport and communication and social protection.

Video snippets

Information gateway

RAPID researchers are closely monitoring research, analyses, and policy efforts geared towards tax reforms and tackling inequality. The following compendium presents a curated list of various useful resources on the abovementioned issues.

- What are the reasons behind the low tax-GDP ratio of Bangladesh? - Read this op-ed to explore the reasons

- Why does Bangladesh lag behind in tax collection? - Read this op-ed by a former Tax Commissioner.

- Leaf through this paper on issues and challenges of resource mobilization for Bangladesh’s smooth Graduation from the Group of LDCs.

- Read this interview of a former NBR Chairman in which he points out three areas the government can improve to raise revenue and improve taxation management.

- Check out this short article on how the tax regime continues to increase inequality in Bangladesh.

- Leaf through this op-ed on political economy analysis of tax reforms, penned by a former NBR Chairman.

- Read this book chapter on institutional dimensions of tax reforms in Bangladesh.