Dissemination Seminar: Can Bangladesh Absorb LDC Graduation-induced Tariff Hikes?

Will Bangladesh continue to get duty-free market access in the EU after LDC graduation?

RAPID welcomes the government's decision to boost revenue collection from direct taxation

As Bangladesh prepares for graduation from the group of least developed countries and aspires for higher development milestones, strengthening revenue collection is immensely important to fund public spending in various social sectors (e.g., education, health, social protection). The significance of boosting revenue collection has become more prominent in light of the adversities triggered by the Russia-Ukraine war and high commodity prices. With a constrained fiscal space, there remains very little room to provide the necessary support to the vulnerable and affected groups during a crisis. Given this situation, increasing revenue collection must be done in a way which is fair for taxpayers. That is why it is welcome news that the government is aiming to increasingly rely on direct taxation, which can help collect more revenue from the better-off income group and tackle the growing inequality. RAPID has been arguing for this direction of travel for some time. It will now contribute to supporting the government in making this important policy shift a reality.

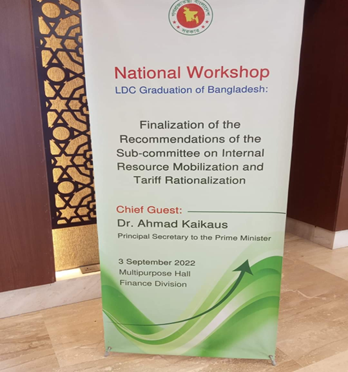

On the 3rd of September, at a national workshop on internal resources mobilisation and tariff rationalisation in Bangladesh, a national study group underscored the need for collecting more revenue from direct taxes.

On the 3rd of September, at a national workshop on internal resources mobilisation and tariff rationalisation in Bangladesh, a national study group underscored the need for collecting more revenue from direct taxes.The tax policy study group recommends reversing the current ratio between direct and indirect taxation from 35:65 to 70:30 in favour of direct taxation.

This will shift taxation from taxes like VAT – which are more regressive and disproportionately paid by lower income groups – to taxes like income tax which are more progressive.

The challenge now is to make a reality of this decisive policy shift. It will take time, requiring strategic actions to expand the income tax base in a way which does not reduce growth and tackle inequality.

Welcome move by the government

At the workshop, study groups presented their recommendations on tax policy, tariff rationalisation, and export assistance. The studies were undertaken to devise strategies for mitigating adverse impacts from the country's graduation from the least developed country group. Presenting the recommendation on taxation issues, Dr Sams Uddin Ahmed, Member (Tax Policy) of the National Board of Revenue (NBR), underscores taking initiatives to reduce dependency on indirect tax and boost revenue collection from direct taxes.

Presenting the recommendation on taxation issues, Dr Sams Uddin Ahmed, Member (Tax Policy) of the National Board of Revenue (NBR), underscores taking initiatives to reduce dependency on indirect tax and boost revenue collection from direct taxes.Principal Secretary to the Prime Minister Dr Ahmad Kaikaus spoke at the workshop as the Chief Guest. The event was presided over by Senior Secretary of the Finance Division, Ms Fatima Yasmin.

FBCCI President Mr Md Jashim Uddin, BGMEA President Mr Faruque Hassan, BIDS Director General Dr Binayek Sen, PRI Chairman Dr Zaidi Sattar spoke on occasion.

Bangladesh Bank Governor Mr Abdur Rouf Talukder, NBR Chairman Mr Abu Hena Md Rahmatul Muneem, Senior Secretary of the Ministry of Commerce Mr Tapan Kanti Ghosh delivered their remarks as panellists.

RAPID Executive Director Dr M Abu Eusuf attended the event and highlighted the need for a major breakthrough in the automation initiatives and tax audit system to make direct taxation work in the context of current challenges.

RAPID's ongoing work to support this policy shift

RAPID welcomes the recommendations to promote direct taxation. Since January 2022, RAPID has championed this issue to boost revenue collection and tackle the growing income inequality. RAPID has engaged with senior policymakers and advocated the importance of direct taxation in high-level meetings (workshops, seminars, consultations, interviews).Before the budget, RAPID sent recommendations for budget 2022-2023. The recommendations focus on reforming direct taxation to tackle rapidly rising inequality while at the same time strengthening domestic resource mobilization efforts.

Right now, RAPID is developing a policy paper on the same issue. More work will continue to help facilitate the government's efforts to mobilise more resources from direct taxation. To know more about RAPID's work on this issue, click here.